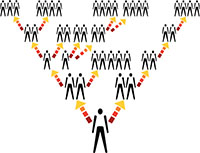

Ponzi schemes (aka Pyramid schemes) frequently involve a fraudster who claims that they can turn a small investment into large profits within a short period of time. However, in reality, the investor’s “profits” are derived from new participants in the program. The fraudsters are talented at making the investments appear legitimate. Ponzi schemes eventually fall apart when it becomes impossible to recruit new investors in the scheme. Typical red flags associated with Ponzi investment schemes include:

Ponzi schemes (aka Pyramid schemes) frequently involve a fraudster who claims that they can turn a small investment into large profits within a short period of time. However, in reality, the investor’s “profits” are derived from new participants in the program. The fraudsters are talented at making the investments appear legitimate. Ponzi schemes eventually fall apart when it becomes impossible to recruit new investors in the scheme. Typical red flags associated with Ponzi investment schemes include:

- guaranteed performance of an investment;

- unlicensed individuals selling unlicensed products such as unregistered securities;

- overly consistent and fantastic returns;

- complex strategies that are not clearly explained;

- missing or incomplete documentation;

- account discrepancies; and

- pushy or high pressure sales tactics.

If you or someone you know is the victim of a Ponzi scheme contact the attorneys at Mathews Giberson LLP to see if we can assist you with the recovery of your funds.